2024

Residents & Fellows

Survey Report

Compensation, Debt, Burnout & More

Panacea Financial

March 2024

Download the PDF

minute read

Skip Ahead

Contents

Medical residents and fellows are an essential part of the U.S. healthcare system. This group endures rigorous training as they prepare for medical practice, which can come at a cost, both personally and financially.

Panacea Financial, a national financial technology company for doctors, initiated the Residents & Fellows Survey to understand the successes, challenges and stressors that medical trainees face and ensure their voices are heard.

As we share these findings, we hope that this report will continue the necessary conversation around the challenges that trainees face and how these problems can be addressed.

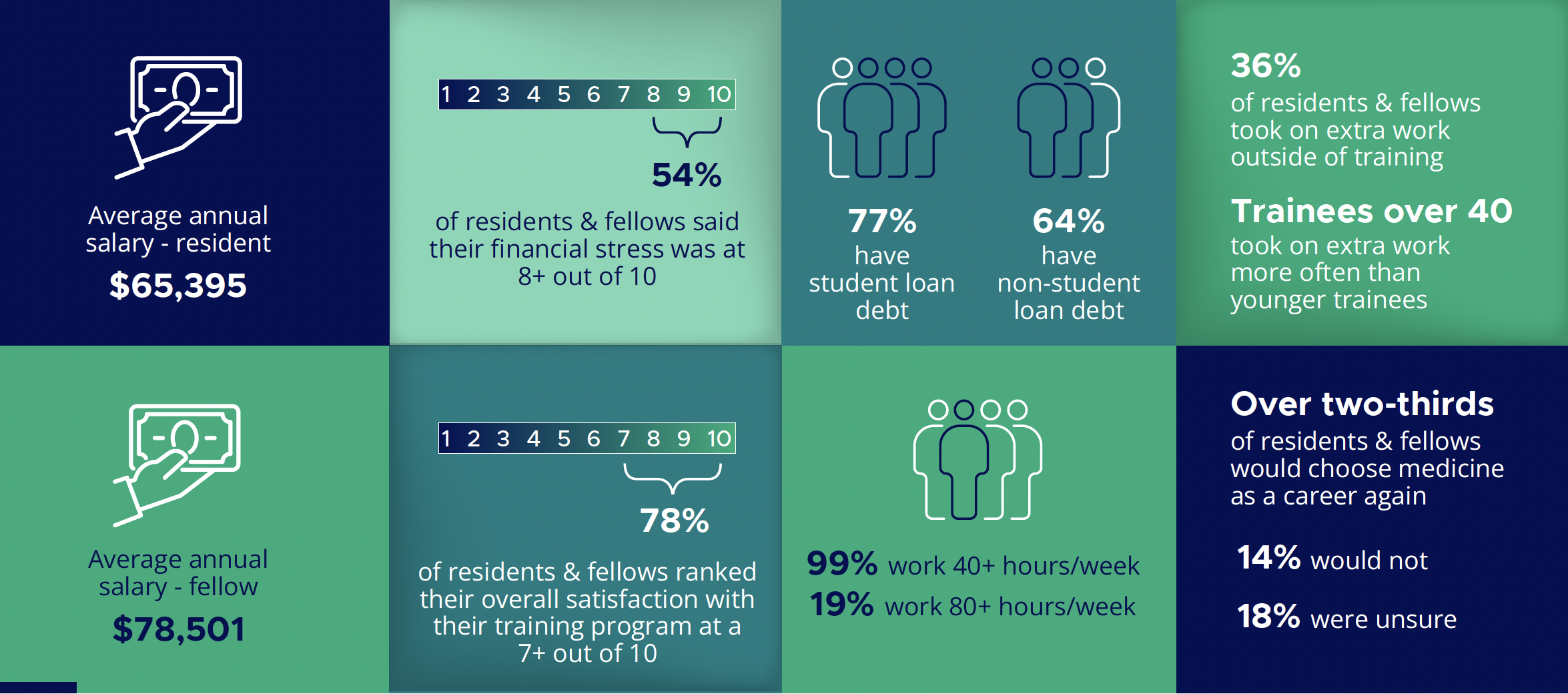

Key Findings

- Average annual salary – resident: $65,395

- Average annual salary – fellow: $78,501

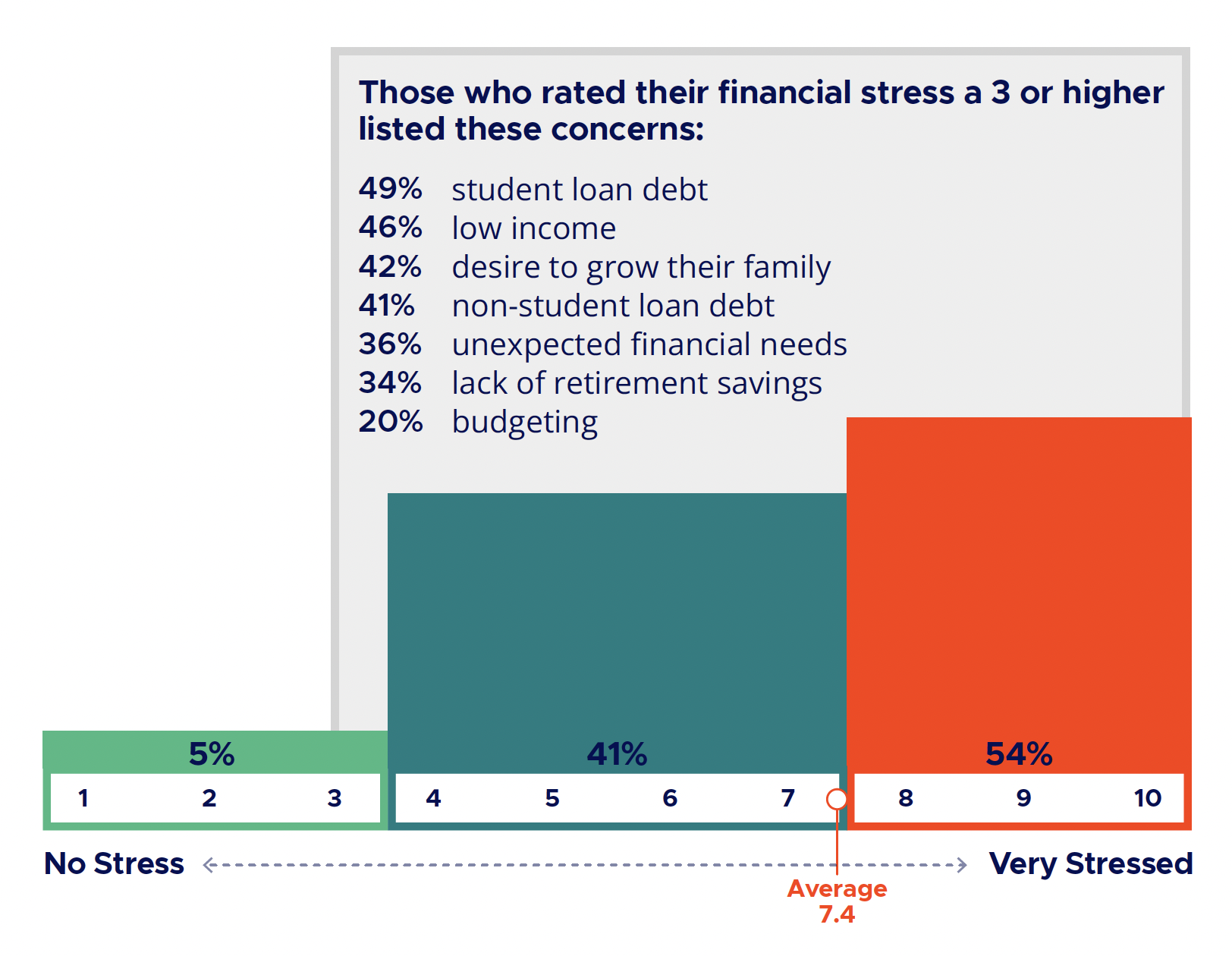

- 54% of residents and fellows said that their financial stress was at 8+ out of 10

- 78% of residents & fellows ranked their overall satisfaction with their training program at a 7+ out of 10

- 77% have student loan debt

- 64% have non-student loan debt

- 99% work 40+ hours/week

- 19% work 80+ hours/week

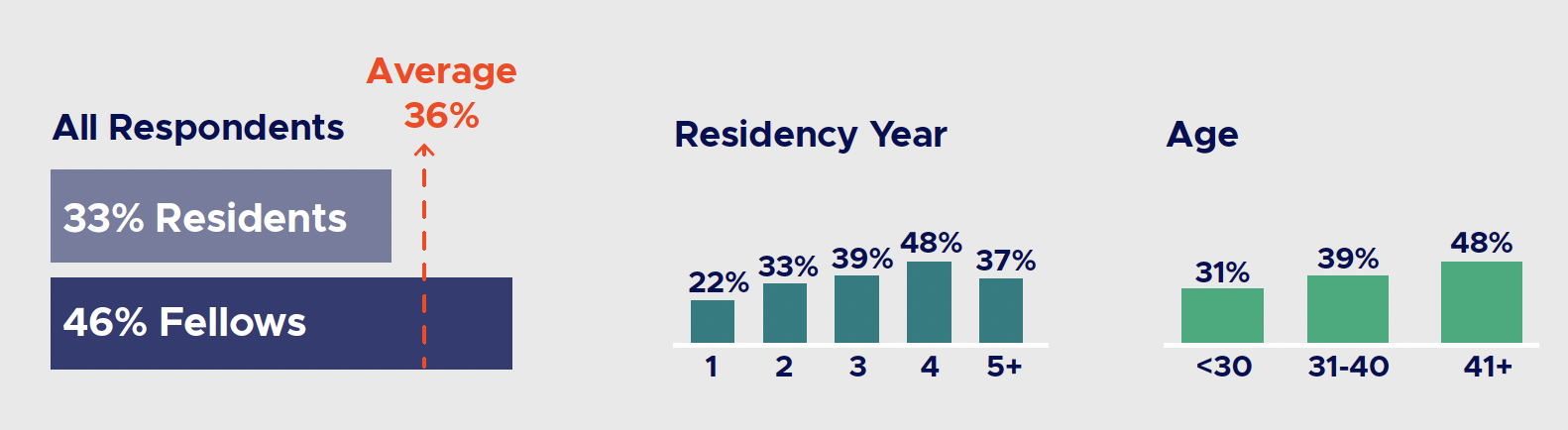

- 36% of residents & fellows took on extra work outside of training

- Trainees over 40 took on extra work more often than younger trainees

- Over two-thirds of residents & fellows would choose medicine as a career again

- 14% would not

- 18% were unsure

Methodology

10-Minute Online Survey

U.S. medical residents and fellows were invited to participate.

Screening Requirements

Respondents were required to be current U.S. medical residents or fellows.

Sample Size

630 respondents met the screening criteria and answered questions in the survey.

Survey Period

November 6, 2023 to January 15, 2024

Sampling Error

The sampling error is 3.8% at a 95% confidence level using a point estimate of 50% (+/-)

Respondents who completed the survey were entered into a sweepstakes for a chance to win 1 of 3 $150 Amazon gift cards. Respondents were awarded an additional entry for each additional respondent who used their referral code.

Compensation

Resident and fellow salaries have been a hot topic for many years. Residents can work 80+ hours per week while earning very little when compensation is divided by hours worked.

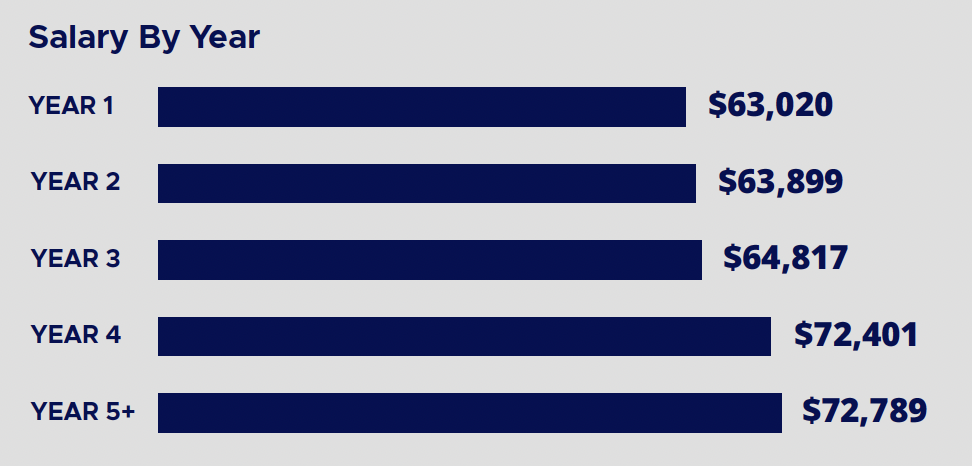

The average salary for resident respondents was $65,395. For fellows, it was $78,501. Though residents often see increases in salary as they move further in their training, we found that over the course of four or more years of training, the increase was less than $10,000.

Because fellowship follows residency, fellows often enter this stage of training at a higher salary, but it doesn’t compare to the salaries of their peers who have already begun practicing.

Average Compensation

Residents – $65,395

Residents often see raises in salary through training, over four or more years, the increase was less than $10,000.

Fellows – $78,501

Fellows often have a higher salary than residents but lower than peers who have already begun practicing.

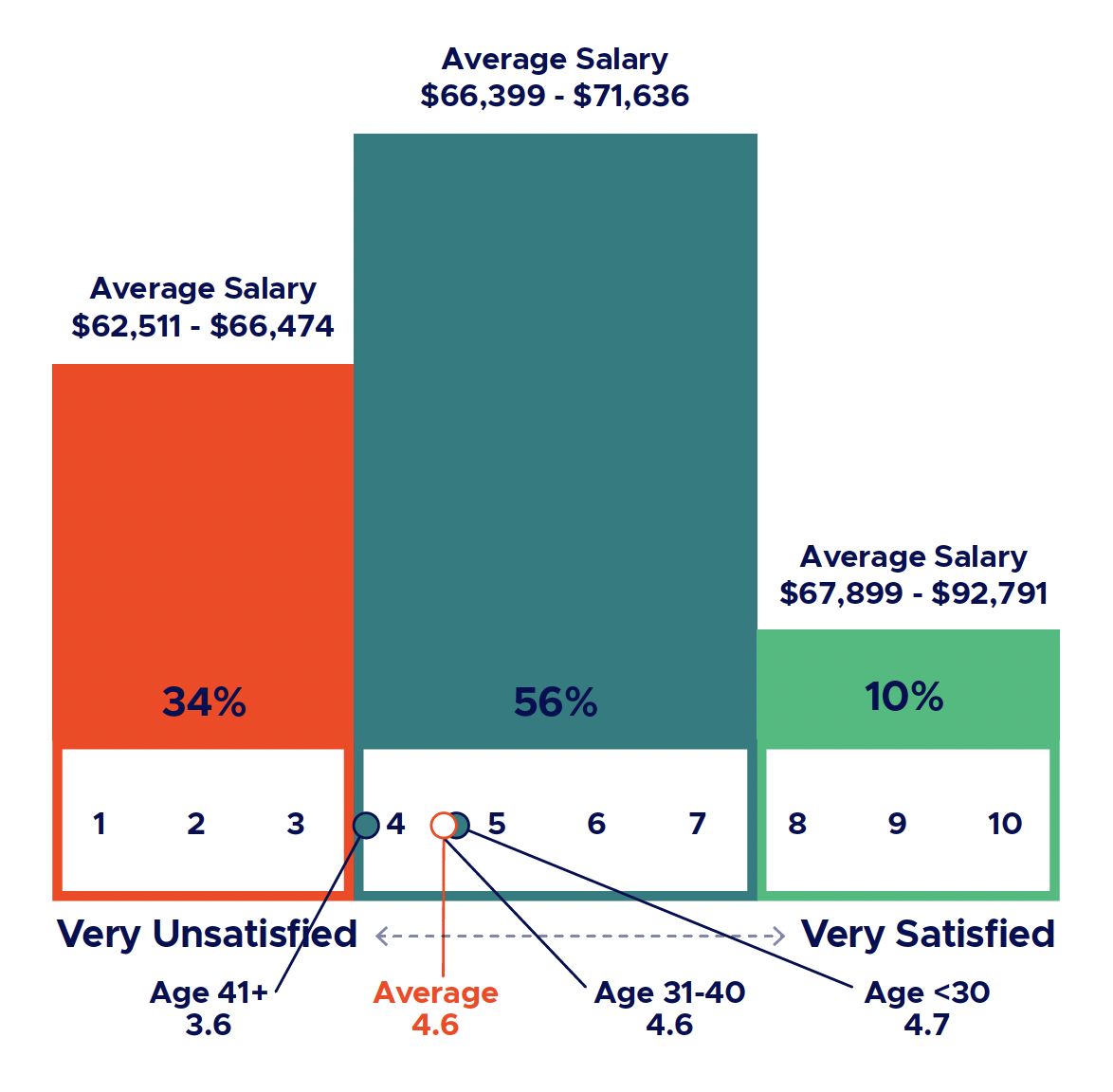

Compensation Satisfaction

When asked how satisfied they were with their compensation, residents and fellows answered with an average of 4.6 out of 10 (where 1 was very unsatisfied and 10 was very satisfied). The majority of answers fell within the 3 to 7 range.

When cross referenced with average salary, there was no clear trend as to what salary results in greater satisfaction, except for those who answered with 10. Those respondents had an average salary of $92,791, significantly higher than average salaries for other scores.

When broken down by age, salary satisfaction was markedly less for residents and fellows 41 or older. For trainees aged 40 or younger, salary satisfaction was an average of 4.6, but that dropped for those aged 41 or older to an average of 3.6. This may be because these trainees had fewer years of earning potential or were earning less than they had in a previous career or when compared to peers of a similar age.

Infographic: Medical Residents’ & Fellows’ Compensation

Medical residents and fellows endure rigorous training and long hours to become practicing physicians. Despite their important role in healthcare, they often face financial challenges...

Average Doctor Salary By Specialty

Becoming a doctor requires years of education, training, and dedication. While the noble profession of medicine is often chosen due to a passion for healing...

How Much Do You Make in Medical Residency?

Once you finish medical school, it’s time to embark on the next phase of your career: medical residency. This hands-on experience is a graduate-level step...

Extra Work

Because of the financial strain of training, some residents and fellows choose to take on extra work to supplement their income.

By Year

Of respondents, 36% earned extra income through a side gig. Some trainees are not allowed to work outside of their program, especially first-year residents. This was illustrated by the increase in residents taking on outside work after their first year of training.

By Type

Of those 36% who worked outside of training, 64% reported moonlighting, working in a medical role outside of their residency or fellowship. Of the fellows who responded to the survey and said that they freelance, 77% reported moonlighting whereas only 60% of residents did the same.

By Age

Age also played a factor in likelihood of working outside of their training program—taking on extra work was more common for those 41 and older. Reasons for this could be a need to support an older family, being more settled into their training program, or a desire to keep up with the lifestyles of their non-doctor peers.

Financial Stress

Residents and fellows rated their stress about finances at an average of 7.4 on a scale from 1 to 10 (where 1 was no stress and 10 was very stressed). Over half of trainees (54%) said their financial stress was at an 8 or higher.

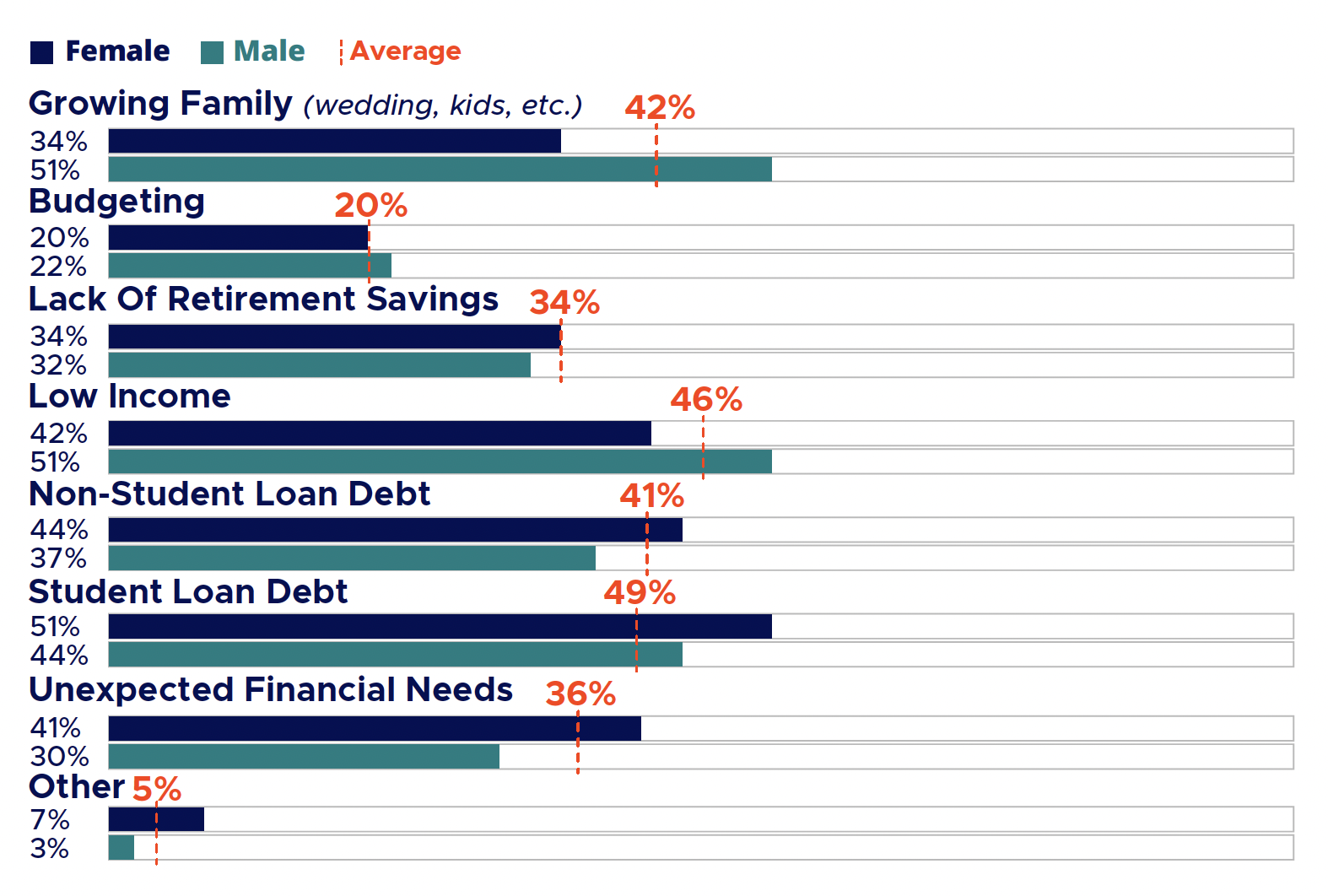

When broken down by gender, both men and women had low income, 51% and 42% respectively, and student loan debt, 44% and 51% respectively, in their top three concerns. Men also ranked growing their family (e.g. wedding, having kids, etc.) in their top three (51%), while women ranked non-student loan debt (44%).

Other:

- Buying first house

- Low income in high cost of living as a single person taking care of others

- Fertility preservation not covered by insurance; important for female residents

- Immigration related costs

- Increasing medical & mental health expenses

Quotes

“The lack of any retirement benefit is particularly distressing for me. By the time I finish training I will be in my mid 30s with almost nothing saved.”

Third-year fellow in North Carolina

“As a non-traditional student, my main issue with our salaries revolves around having children and raising a family through the college/medical school/residency process. Because of how busy I was, my wife stayed home with our children in medical school which led to credit card debt that’s been difficult to get out of.”

Second-year resident in South Carolina

“Especially as a fellow, it’s frustrating. My med school colleague of my same year made $400,000 last year with the training I already have.”

Fellow in New York

“I am living paycheck to paycheck. The one benefit to not making a lot of money is qualifying for benefits for free/reduced childcare cost. I go to food pantries when my work schedule allows, to try to reduce the amount of money I am spending. I have been doing this since medical school.”

Second-year resident in California

“I would consider working extra or moonlighting to make extra money. However, I feel that my fellowship duties take too much of my time.”

First-year fellow in California

Tips For Budgeting, Benefits & Expenses During Residency From Physicians

The transition from medical school to residency can be a challenging task, especially with limited income to cover living expenses and other needs. With long...

Why Monthly Budgeting Is Critical For Doctors-In-Training

Stress around your personal finances can negatively impact your ability to put patient care first. Financial stress has been identified as the second highest cause...

The Hidden Costs of Financial Stress in Med School

Are money worries affecting your overall wellness? Stressing out over how to pay rent and credit card bills, afford residency applications, and still make ends...

Student Loan Debt

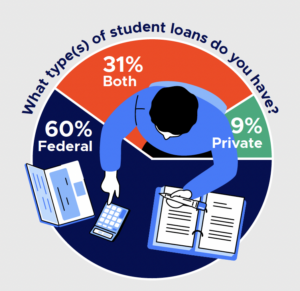

Physicians take on some of the most student debt of any profession. Many medical school graduates continue to pay off debt well into their careers. So, it’s no surprise that 77% of survey respondents had student loan debt—80% of residents and 64% of fellows.

Of the respondents who ranked their financial stress at a 3 or greater out of 10, 63% chose student loan debt as one of their top three stressors.

Most medical students use federal student loans to fund their education. Of respondents who had student loans, 91% had at least some federal student loans, while 40% had at least some private student loans.

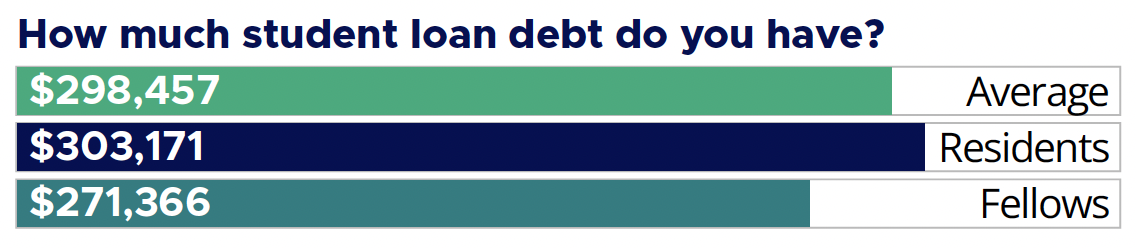

Based on survey responses, the average student loan debt for residents and fellows was almost $300,000 with the highest reported student loan debt balance reaching $850,000.

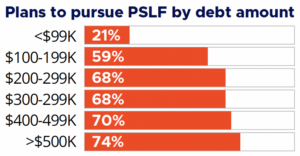

Of those with federal student loans, 65% planned to pursue Public Service Loan Forgiveness. When broken down by amount of debt, there was a steady increase in plans to pursue PSLF as debt load increased.

Student Loan Terms Borrowers Should Know: A Comprehensive Guide

Doctors often take on six-figure student loan debt as they make their way through school. To navigate the world of student loans successfully, it’s essential...

Understanding Student Loans: Frequently Asked Questions Answered

As the cost of medical, dental and veterinary school continues to rise, many prospective and current doctors find themselves burdened by significant student loan debt....

A Doctor’s Guide To Refinancing Student Loans

Student loan refinancing is when a private lender pays off your student loans and provides you with a new loan with different terms, often at...

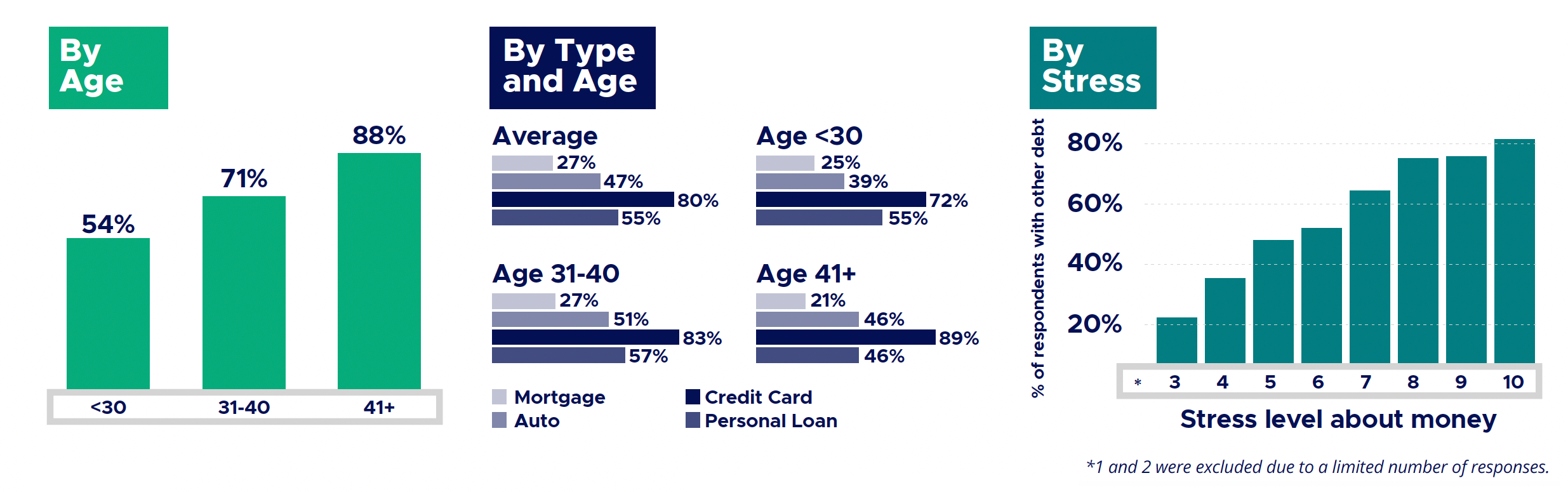

Other Debt

Student debt weighs heavily on many residents and fellows, but most also have other, non-student debt. Of respondents, 64% reported having non-student debt (broken out, it was 65% of residents and 58% of fellows). Based on responses, financial stress increased as carrying other debt increased.

Of respondents, residents and fellows 41 or older, were more likely to have other debt than their younger colleagues. Almost 90% of respondents over 40 carried credit card debt.

Quotes

“$65,000 in credit card debt with about half at 29.99% is absolutely drowning me, and I don’t know how to make it better. I’m considering bankruptcy of my credit cards.”

First-year resident with $483,000 in student loan debt

“Even without student loan debt, I am not where I want to be financially and I am one negative event away from a bad financial situation.”

First-year resident with no student loan debt

“I come from a financially illiterate family, and while I know that I am ultimately responsible for my own decisions and the agreements I enter into, I do also feel I was not able to comprehend the magnitude of the debt I was agreeing to in order to pursue my dream. Were I to know then what I know now, I would have chosen a different career path. The financial stress has bled into other areas of my life and affected many personal relationships.”

Fourth-year resident with $350,000 in student loan debt

“I was very lucky to be able to go to med school for free.”

Fellow with $27,000 in student loan debt

“The SAVE plan for federal loans is very affordable, but it’s the private loans that are nearly unmanageable.”

First-year resident with $363,000 in student loan debt

How To Pay Off Credit Card Debt For Doctors & Doctors-In-Training

We get it, because we’ve been there. As a doctor or doctor-in-training, you are likely incredibly busy. We know speed and convenience are crucial, so...

Credit Card Vs. Personal Loan Calculator

Credit Card vs. Personal Loan Calculator Save with a low, fixed-rate PRN Personal Loan. When tight on cash, many take on credit card debt. Often,...

How Does Debt-To-Income Ratio Affect Doctors?

Medical, dental and veterinary professionals endure years of education and training to be well equipped to serve their patients. Despite the years of learning, doctors...

Post-Training Plans

When asked about post-training plans, the majority of respondents (51%) indicated that they intended to become an employed physician. Plans also included academic medicine (27%) and practice ownership (17%).

When divided by resident and fellow, fellows were more likely to anticipate entering academic medicine, 41% vs. 24%, while residents were more likely to plan to become an employed physician, 53% vs. 43%. Responses differed by gender as well. Women were more likely to plan to enter academic medicine, 32.5% vs. 22%, and men were more likely to plan to become practice owners, 23.5% vs. 12%.

Other plans:

- “Do another residency to switch specialties.”

- “Military physician.”

- “Employed then academic once I gain enough experience.”

- “Locums.”

- “Haven’t decided just yet.”

Bringing Passion & Purpose to Practice – Customer Spotlight

Dr. Jamine Ifedi, DDS, MBA, opened his Charlotte-based dental practice, Empire Dental Group, with the help of Panacea Financial. What led him to practice ownership...

Considering A Job Change? Here’s What Doctors Should Know

Deciding to leave one job for another can be a big life change. Whether making this decision because of advancement opportunities, desire for a new...

The Changing Landscape Of Medicine: Trends & Key Benefits Of Private Practices

Key takeaways: Private practice employment and ownership is declining. Owning and working for a private medical practice can allow a physician to have greater autonomy,...

Burnout and Workload

Burnout

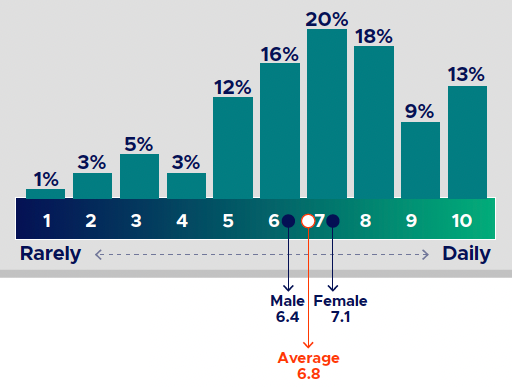

Respondents reported often experiencing burnout with an average rating of 6.8 on a scale from 1 to 10 (where 1 was rarely and 10 was daily). The averages when separated between residents and fellows did not change significantly. Women reported slightly more frequent burnout at 7.1, while men’s answers averaged to 6.4.

Workload

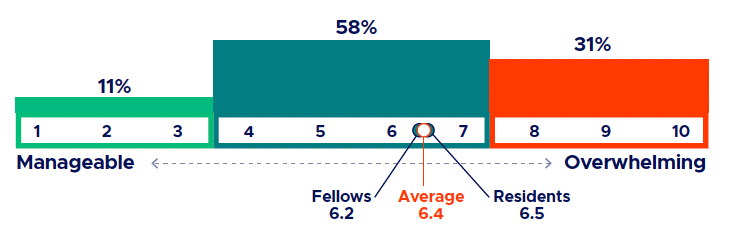

On a scale from 1 to 10 (where 1 was manageable and 10 was overwhelming), residents and fellows surveyed perceived their workload at an average of 6.4.

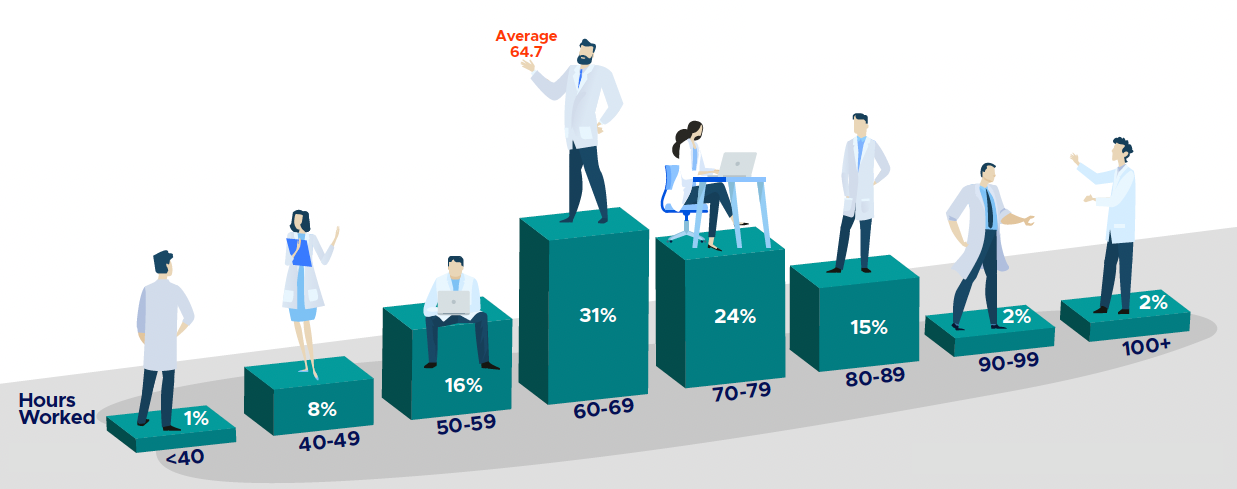

When asked how many hours they worked per week including on-call duties, the average was 64.7 hours. Ninety-nine percent of residents and fellows worked over 40 hours, the traditional workweek; 19% of respondents worked over 80 hours per week.

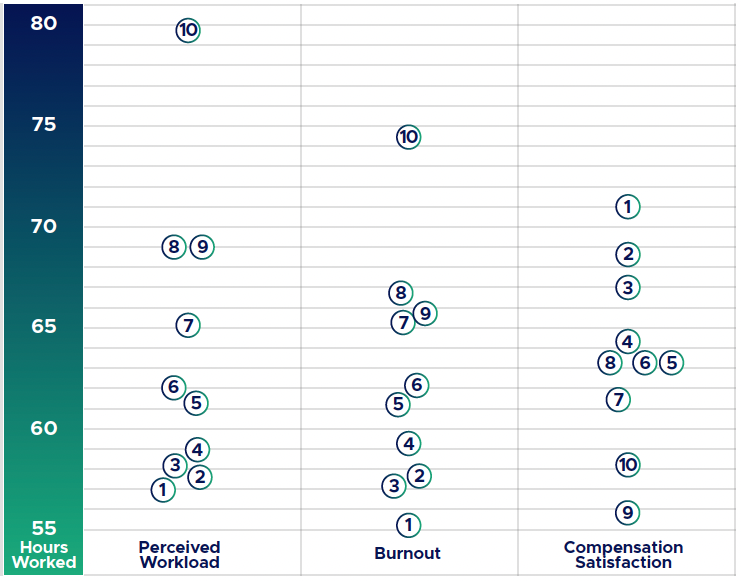

We took a look at how the actual number of hours worked related to a resident or fellow’s perceived workload. Average hours worked rose steadily as perceived workload increased. Individuals who rated their workload as a 1 worked, on average, 57 hours per week, the lowest average hours of all ratings. Those who rated their workload as a 10 worked, on average, 79.9 hours per week, the highest of all ratings.

When compared to hours worked, burnout levels also rose steadily as hours worked increased. Meanwhile, satisfaction with compensation consistently decreased as hours worked increased.

Quotes

“Extremely burnt out especially in patient rotation. I am completely dependent on mental health counseling to be able to keep going. Discrimination is felt based on gender and race a lot of times and it adds to our burnout.”

Third-year resident in Florida

“The first year of fellowship was much worse than my current year in terms of hours worked, but the burnout occurred in residency and there has been no time to recover.”

Second-year fellow in Georgia

“I barely get to see my family, and it is very sad to watch my baby grow up and not be able to be a part of his life.”

Second-year resident in Wisconsin

“A huge financial benefit can be if programs provide compensation for food, parking, etc since, when you have a lot of hours and little time to prep your week, people end up spending more which can be challenging when you’re being financially mindful!”

First-year resident in Minnesota

“I would feel somewhat less burned out if I was at least fairly compensated, or at least made some form of overtime for the weekends and holidays away from family.”

Fellow in in South Carolina

“I wish I had control/could give input on how my yearly schedule will be to optimize it for my personal preference and situation. Some people get lucky with their scheduling, and some people get the short end of the stick through no fault of their own.”

First-year resident in Texas

Addressing Burnout Among Residents & Fellows

Burnout has long been an issue in the healthcare community, but especially for residents and fellows as they can work long hours with very little...

Doctors With The Best Work-Life Balance

It’s no secret that doctors work hard. Long hours and overnight shifts could make it challenging for physicians to feel satisfied in both their professional...

Best Meditation Apps to Manage Medical School Stress

Struggling with (or afraid of) burnout in medical school? Here are our 4 favorite meditation apps for doctors-in-training As a doctor-in-training, your most valuable commodity...

Satisfaction

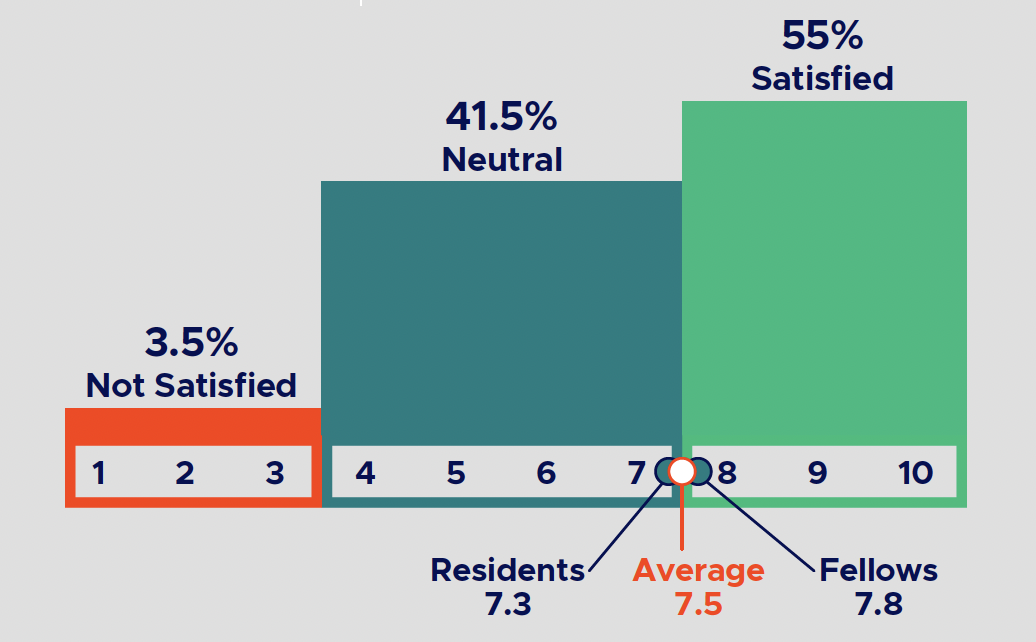

Surveyed residents and fellows were fairly satisfied with their residency or fellowship experience. Of respondents, 78% ranked their overall satisfaction at a 7 out of 10 or higher (where 1 was not satisfied and 10 was very satisfied). Only 6% said their experience ranked at less than a 5.

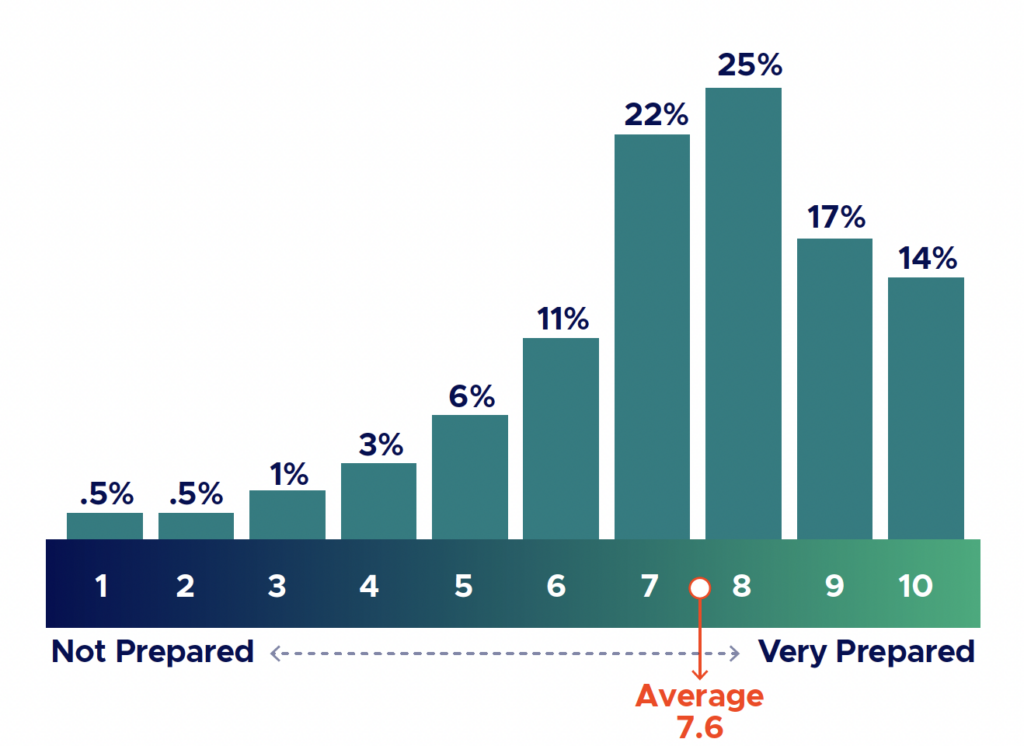

Career Readiness

Respondents also interpreted their readiness for their future career positively, with an average score of 7.6 out of 10 (where 1 was not prepared and 10 was very prepared). Roughly 78% said their preparedness ranked at a 7 or higher.

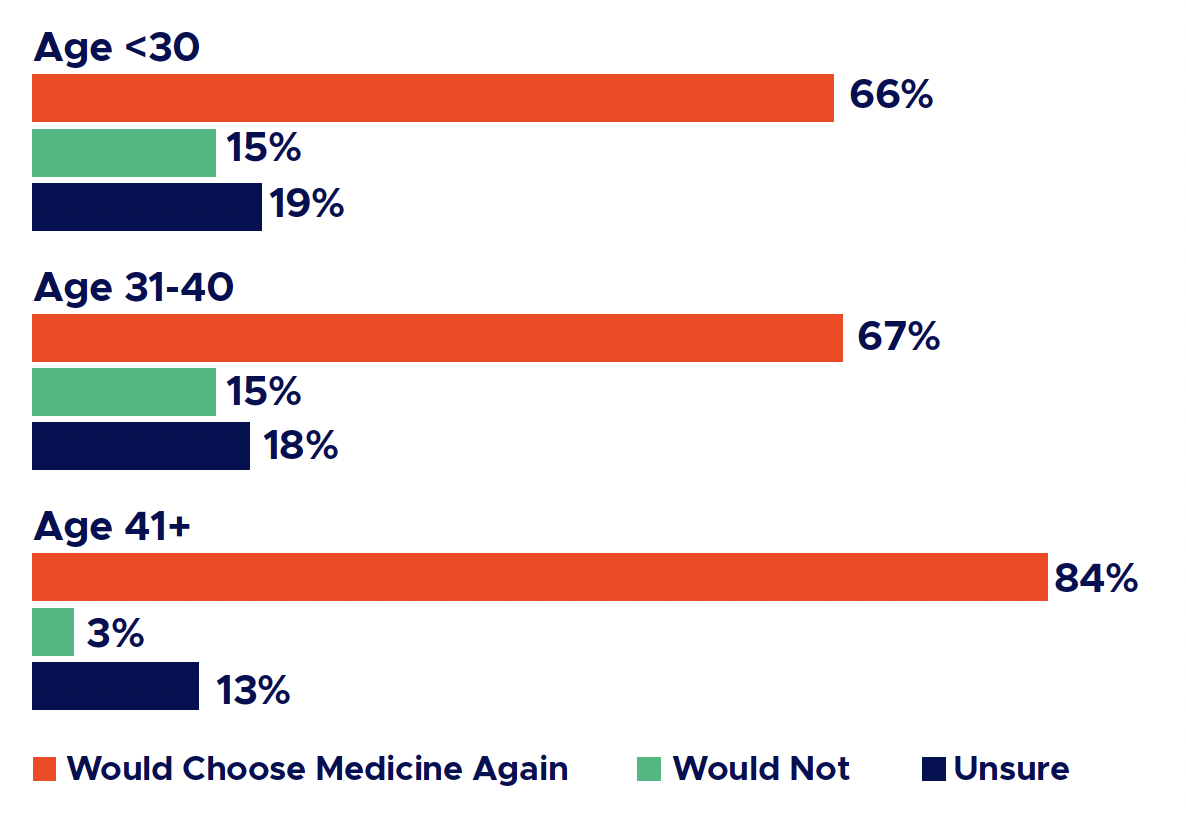

Career Choice

Over two-thirds of respondents said they would choose medicine as a career again, 14% said they would not, and 18% were unsure. Surveyed residents and fellows older than 41 were more likely to say they would choose medicine again than their younger colleagues.

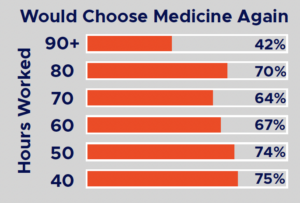

It is important to note that willingness to choose medicine as a career dropped significantly for respondents who indicated working 90 or more hours per week.

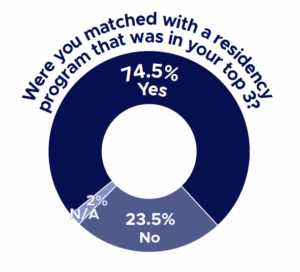

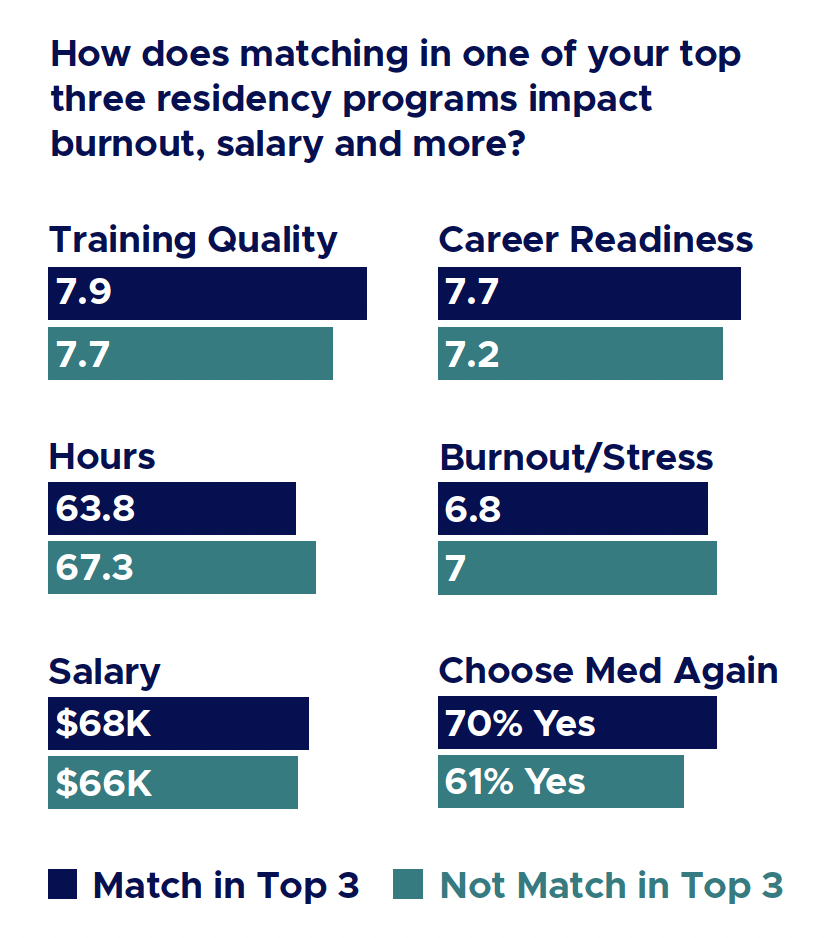

Almost three-quarters of respondents were matched into one of their top three programs.

When looking at satisfaction of clinical training at their program, there was a slight difference between those who did match in their top three (7.9) and those who didn’t (7.2) as well as variations in salary, hours worked, and burnout and preparedness scores.

Of those that matched in one of their top three residency programs, 70% would choose medicine again versus those who did not match in one of their top three programs, of which 61% would choose medicine again.

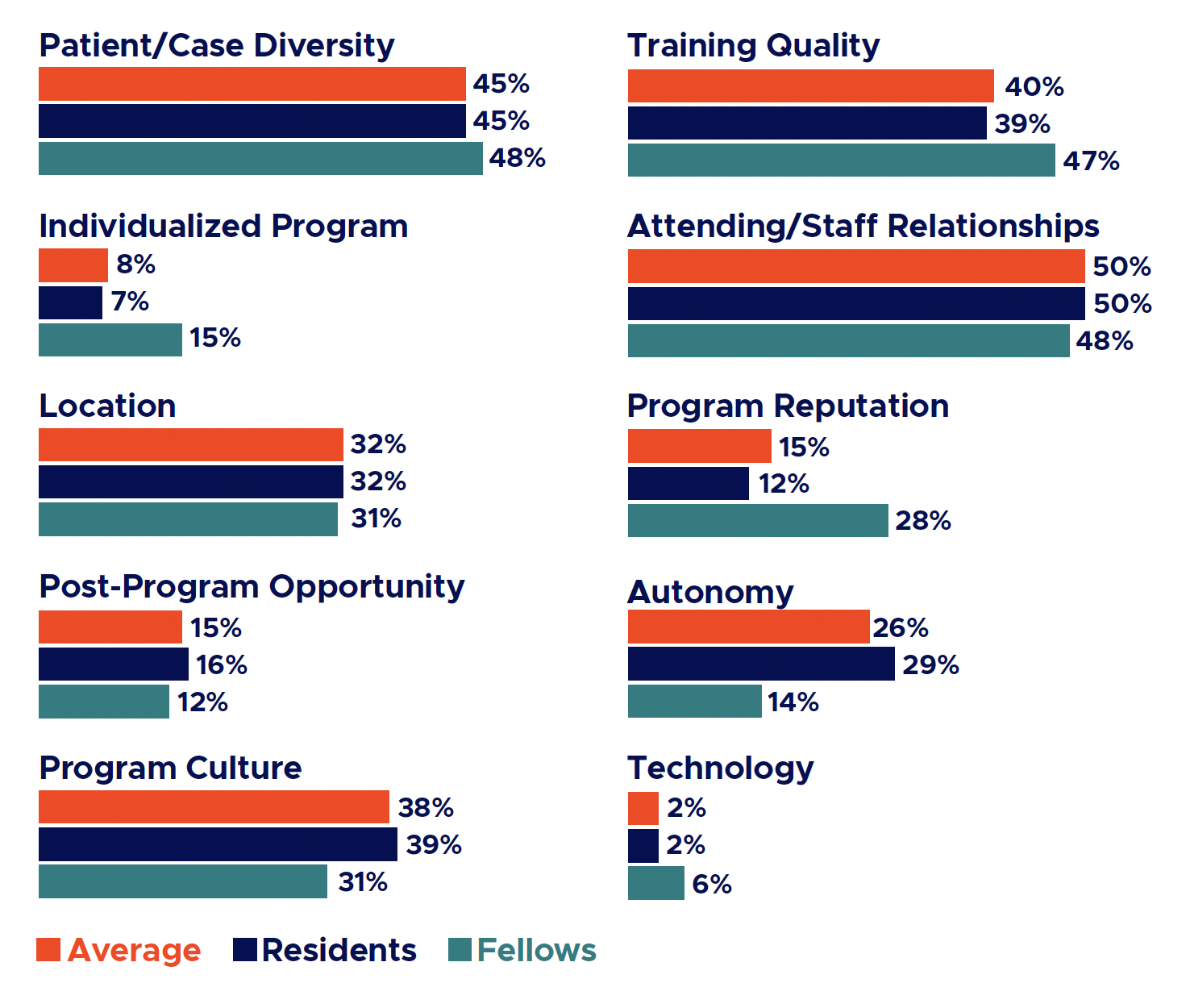

Best Parts of Training

When asked what the best parts of their program were, the aspects that were chosen most often include:

- 50% relationship with attendings/staff

- 45% diversity of patients and cases

- 40% quality of clinical training

- 38% program culture

When broken down between residents and fellows, residents were more appreciative of program culture and autonomy, while fellows placed greater value on quality of clinical training and program reputation.

Comments

“We have a strong focus on wellness at our program, which helps significantly with the burnout.”

“I love the culture of our program, and I feel the program offers all the rotations that we really need to be ready for practicing great patient care.”

“Rural medicine is a great setting to train in.”

“Autonomy is huge here. I have a ton, and it’s great for confidence.”

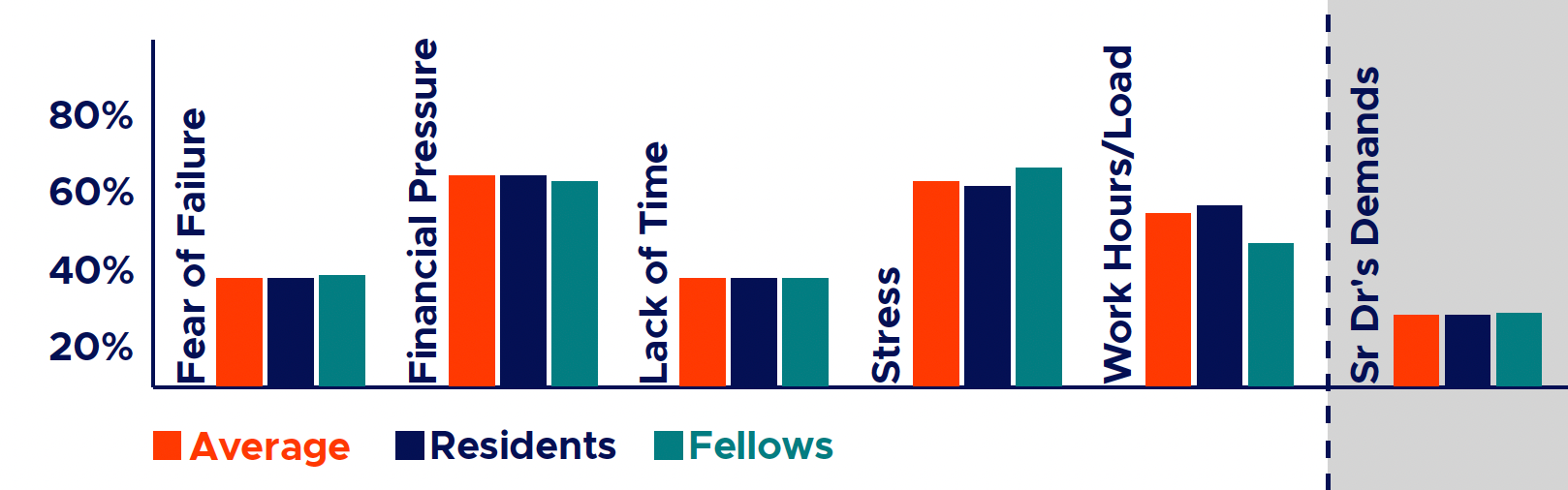

Challenges in Training

When asked about the most challenging parts of their training, respondents identified financial pressures (55%) as the biggest challenge, followed by stress (52%), and workload (44%).

Residents were much more likely to choose workload (46%) than fellows (36%). Male trainees were more likely to choose financial pressures (62% vs. 48%), while female trainees were more likely to choose stress (58% vs. 47%).

When looking at challenging aspects and satisfaction, senior physicians’ personalities and demands had an impact on satisfaction scores. Those who did not select this as being one of the top challenges in training had an average satisfaction score of 7.7. When a trainee selected this, their average satisfaction score dropped to 6.6.

Quotes

“Fitting into the program, feeling accepted, heard and respected is extremely hard.”

“Creating a new support system in a new place.”

“Lack of meaning in work, spending most of the day documenting instead of with patients.”

“Lack of diversity.”

“Fear of losing most of my thirties to a mindset of ‘just make it through’ rather than enjoying some part of life.”

“Fear of losing my love for medicine.”

Areas to Improve

“1. Better vacation/sick day plan without requiring payback for sick days.

2. In person mental health counselor for mental well being. Rates of depression are extremely high among us.

3. More residents to distribute the workload.”

Third-year resident in Florida

“Being a Texan, I feel offering residents free or discounted resources to learn Spanish would be enriching for us given our patient population.”

First-year resident in Texas

“Financial literacy, practice management and the business of healthcare.”

Fourth-year resident in New York

“Less hours on call.”

First-year fellow in Illinois

“Teaching from the attendings; most of my education has been on my own.”

Fourth-year resident in Michigan

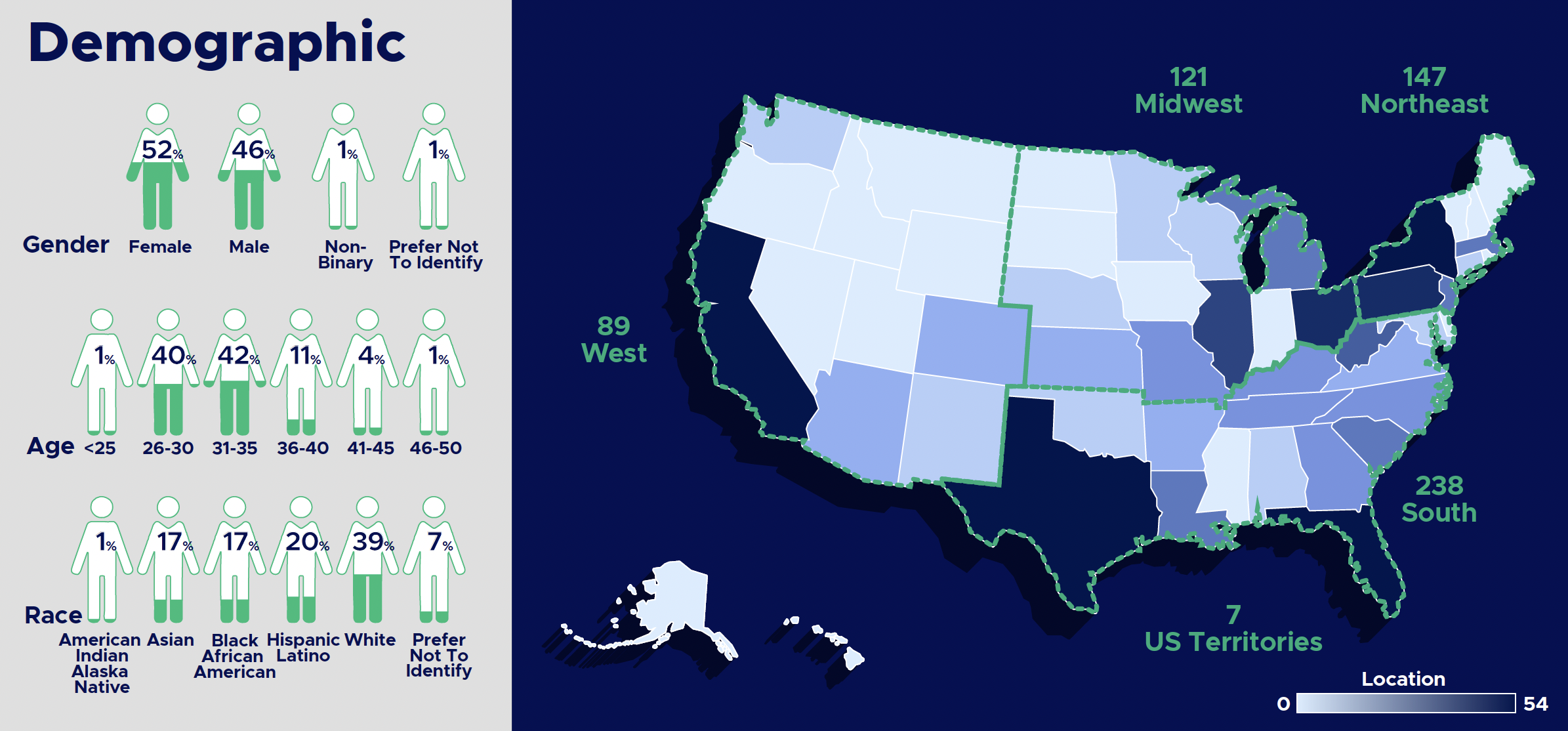

Demographic

Thank You

Banks don’t recognize the hard work and dedication it takes for doctors to get through training, nor do they acknowledge your future as high-income earners.

The idea for Panacea Financial was born out of a desire to provide needs-based care for doctors and doctors-in-training. Panacea Financial grants you access to products and services designed specifically for medical professionals, built by a team that truly understands your needs.

Panacea Financial tailors products and services to medical students, residents and attendings when they need it most.

Doctors and doctors-in-training can expect support from a company that caters to their unique professional experiences. And as new challenges arise, Panacea Financial will be there to grow with medical professionals and show everyone a better way to bank.

Download the PDF